SBI Courier Tracking Track and Trace

Contents:

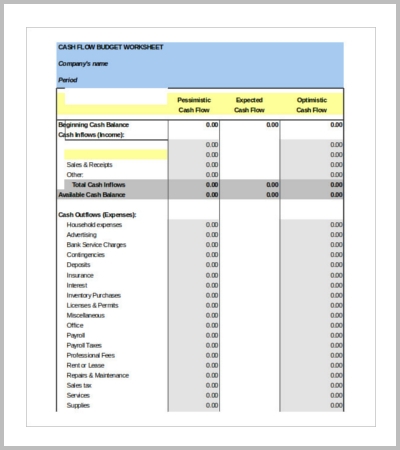

You can also set up AutoPay instructions with an upper limit to ensure that your bills are paid automatically whenever they are due. The upper limit ensures that only bills within the specified limit are paid automatically, thereby providing you complete control over these payments. You will access this site solely for the payment of your bills and you acknowledge that any reliance on any opinion, advice, statement, memorandum, or information available on the site shall be at your sole risk and consequences. Status of your SBI Credit Card application will be displayed. Next, select your Account and enter the total number of Cheque leaves required. B) Where the cheque is credited to a Savings Bank account, such credits will not be reckoned for interest purposes if the cheque is returned unpaid.

You can transfer funds to your trusted third parties by adding them as third party accounts. The beneficiary account should be any branch SBI.Transfer is instant.You can do any number of Transactions in a day for amount aggregating Rs. 5 lakhs. Please note that the cut-off time for OLTAS and CBEC payment is 8 P.M. IST. Any transactions created after the cut off time will be processed after 7 A.M. You can now proceed to complete your credit card application. After successful OTP verification, you will be taken to your partially filled credit card application.

On Sunsbi cheque book status, the department said in a press statement that it has found evidence of attempted tax-evasion at “a startup based in Pune and Thane”. While it didn’t name the company, there’s little doubt which one it was referring to. On that page, you are provided the information related to the issue date of the new cheque book. For viewing the quote and submission of application, an authorization, such as a One Time Password, is required. The Bank has the absolute discretion to amend or supplement any of the Terms of Service (Terms & Conditions) at any time, without prior notice.

Youngest Indian unicorn; Pine Labs hires bankers for IPO

If you can gather a proper date, that will be meaning that you will be provided the cheque book soon. Once you have clicked on the option of cheque book request, you have to click on the history tab to see the request and then click on the account number. On the request and inquiries option clicked, you will be provided a page to search for the cheque book request option. If a person wants to know the ordered cheque book’s status, they can also get it online.

1.3 Cheque clearing process under revised scenario of CTS based clearing system. Taxmen believe officials at co-op lenders and NBFCs may have worked with some individuals to exchange unaccounted old currency notes after note ban. The bank attributed the growth to “higher customer acquisition in smaller cities and towns”. EPFO has issued the set of FAQs to help the employees who want to withdraw money from their EPF account to meet the financial emergency induced by the novel coronavirus-induced lockdown.

Select the account for which you require a cheque book, enter the number of cheque leaves required and the mode of delivery. The Funds Transfer facility enables you to transfer funds within your accounts in the same branch or other branches. You can transfer aggregating Rs.5 lakhs per day to own accounts in the same branch and other branches.

- The Bank will endeavor to correct such errors wherever possible on a ‘best efforts’ basis.

- Such services will be available only when the OSS are functional.

- You can also define beneficiaries to your accounts These beneficiaries may be third parties having accounts in the same bank, VISA Debit /Credit Card holders, or Beneficiaries who hold accounts in other banks.

- The RTGS system facilitates transfer of funds from accounts in one bank to another on a “real time” and on “gross settlement” basis.

- Improper use of the SBI Apply Online service by a User/applicant.

The application is available free of charge for both the Play store and the iOS store. It brings tons of benefits like 24/7 fund transfers, instant loans, booking related to travel and entertainment, and much more. SBI YONO is a digital banking application from State Bank of India. Check here the step-by-step guide for the users to request an SBI checkbook using YONO App. 1.14 Bank branches situated at centres where no clearing house exists, would present local cheques on drawee banks across the counter and proceeds thereof would be credited, at the earliest, on realization. Getting a new chequebook for the bank is the most important thing in the banking sector.

How To Lock/Unlock SBI Net Banking Access

Bank will not use such document for any other purpose like updating KYC details, etc. The Internet per se is susceptible to cyber-crimes like phishing, vishing , SMSing , compromising of User’s system security, etc., that could affect instructions to the Bank. While the Bank shall endeavor to protect the interests of customers, there cannot be any guarantee against such cyber-crimes and other actions that might affect security of information.

SBI ATM Cash Withdrawal, Cheque Book Charges, Fees for Other Transactions Explained: Check Out – News18

SBI ATM Cash Withdrawal, Cheque Book Charges, Fees for Other Transactions Explained: Check Out.

Posted: Wed, 13 Jul 2022 07:00:00 GMT [source]

1.11 Cheques deposited at branch counters and Cheques deposited in the drop-box within the branch premises, before the specified cut-off time, will be sent for clearance on same day, for which the clearance period will be T+1 working day. Cheques deposited after this cut off time will be sent for clearing on next day, for which clearance period will be T+2 working days. To enhance security in carrying out banking and other transactions, we recommend that customers adopt the following practices. Banks the world over expect their customers to do this much in mutual interest. SBI offers a wide range of products, low Interest Rates, Interest calculation on daily reducing balance with low processing fee, no hidden charges and no pre-payment penalty. SBI Internet Banking is the best platform to access online banking services.

CHEQUE BOOK STATUS

If you have any queries, kindly approach your branch, quoting the reference number generated for the request. You can opt to collect the draft in person at your branch, quoting a reference to the transaction. A printed advice can also be obtained from the site for your record.

Any terms and conditions relating to the loan schemes of the Bank other than these Terms will continue to apply. ‘One Time Password ‘ refers to one time 6 digit pass code sent to the mobile number provided by an applicant during a session, for verification of his/her mobile number. Next screen select your account number, select the number of leaves and submit your request.

WaterBridge Ventures, Chiratae Ventures, SAIF Partners and Orios Venture Partners have continued to pursue seed-stage deals over the last two months, when most investors put away their cheque books. Banks offer different interest rates on savings accounts, here is a quick comparison of SBI, HDFC Bank, ICICI Bank. Depending on the account status, banks mark such accounts as dormant or inactive. As it’s likely that you’re not keeping an eye on your account, this is a precaution to protect your interests. Applicants can track the status of their application by using only the application reference ID and mobile number. ‘Personal Information’ refers to any information about the applicant obtained by the Bank in connection with the SBI Apply Online services.

You can set limits for demand drafts issued from your accounts or use the bank specified limit for demand drafts. In addition to this, SBI Card team will send an SMS on your Registered Mobile Number with a link to generate your E-card. With this E-card you can view your credit card details digitally, even before your physical card reaches you, and start shopping online instantly. 1.16 SC/DDP automation has been implemented for collection of outstation cheques of other banks from centres where speed clearing system is not available. 1.12 As a policy, Bank would give credit to the customer account on the same day after day’s clearing settlement takes place. Withdrawal of amount so credited would however be permitted as per the cheque return schedule of the clearing house.

That mean bank has accepted your request and issued Cheque Book for your account. Your new issued Cheque Book will be delivered within 7 days to your mailing address. As you know, now you can apply for a new SBI Cheque Book online without visiting branch. You can also request Chequebook through SMS if you don’t have net banking or mobile banking. From July 1, non-financial transactions at branches, ATMs, and cash deposit machines will be free-of-cost at both SBI branches and non-bank branches as well.

Legal threat for India’s data law; crypto exchanges eye targeted ads

To book bus tickets to destinations in Karnataka, log on to the KSRTC website. Provide details about the start and end points of your journey, date of journey and number of tickets. Verify availability of seats on the selected date and confirm the transaction. Provide your credentials and select the SBI account that will be debited for the payment. You are provided a KSRTC reference number for your e-Ticket.

State Bank of India Offers 3 Free ATM Transactions In Metro Cities. Check ATM Charges Here – Outlook India

State Bank of India Offers 3 Free ATM Transactions In Metro Cities. Check ATM Charges Here.

Posted: Mon, 22 Aug 2022 07:00:00 GMT [source]

You can manage your account and access many online services at your home. You can also order SBI new Cheque Book through SBI Internet banking facility. SBI Mobile Banking app is another way to apply a new Cheque Book online. You can apply 20, 30 and 50 leaves Cheque Book using SBI mobile banking.

Such services will be available only when the OSS are functional. Availability of Apply Online is also dependent upon availability of the network. In addition, Apply Online will not be available during downtime.

Customers and non-customers of Punjab National Bank can now use WhatsApp banking services. You can generate the online account statement for any date range or for any month and year. The account statement can be viewed online, printed or downloaded as an Excel or PDF file. You also have the option to select the number of records displayed in each page of the statement. You can apply for a new account only in branches where you already have accounts. You should have an INB-enabled account with transaction right in the branch.

Download and Install the official mobile banking app of SBI. If you don’t have this number then you can not check the status. According to the State Bank of India website, here are the transactions for which you will receive an SMS alert.

What Is A Cancelled Cheque? – Forbes Advisor INDIA – Forbes

What Is A Cancelled Cheque? – Forbes Advisor INDIA.

Posted: Fri, 07 Oct 2022 07:00:00 GMT [source]

The Bank will endeavor to correct such errors wherever possible on a ‘best efforts’ basis. If the User notices an error in the loan application provided to him/her through the SBI Apply Online service, he shall advise the Bank at the earliest. A State Bank of India customer can stop the payment of an SBI cheque that has been issued using simple steps online, via the Yono app in addition to the traditional method of visiting a bank branch. The Internet Banking application can generate an online, downloadable account statement for any of your accounts for any date range and for any account mapped to your username. The statement includes the transaction details, opening, closing and accumulated balance in the account. 1.3.6 RBI has directed that no changes/corrections should be carried out on the cheques.

Retail loan products such as Home Loan, Auto Loan, Education Loan and Personal Loan can be applied for through this service. After submitting the respective ID and password, you can select your account. After a successful debit, Railways will generate the ticket. E-ticket can be printed by you whereas the i-ticket will be dispatched by IRCTC at the given address.

1.11.2 All drop-boxes shall clearly indicate the timeline as above upto which cheques dropped in the drop boxes would be sent for clearing on the same day. 1.8 Cheques that need to be re-presented without any recourse to the payee shall be presented in the immediate next presentation clearing, not later than 24 hours,with due notification to the customers of such presentation. Bank’s Cheque Collection Policy was first formulated in 2005 and is reviewed periodically, as per the guidelines issued by Reserve Bank of India /IBA/BCSBI from time to time. The Policy duly approved by Bank’s Central Board shall be known as Bank’s Cheque Collection Policy -2015.