CAC 40 ETF Amundi CAC 40 ETF Why I love the CAC 40

The information set out on this Website is not directed to the United States. U.S. persons (as defined in Regulation S under the U.S. Securities Act 1933) and persons resident in the U.S. may not enter the Website. Information from this Website may not be distributed or redistributed into the United States or into any jurisdiction where it is not permitted. Any securities described on this Website have not been and will not be registered under the U.S.

Wall Street Asset Managers Race for $3 Trillion Active-ETF Prize – Bloomberg

Wall Street Asset Managers Race for $3 Trillion Active-ETF Prize.

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

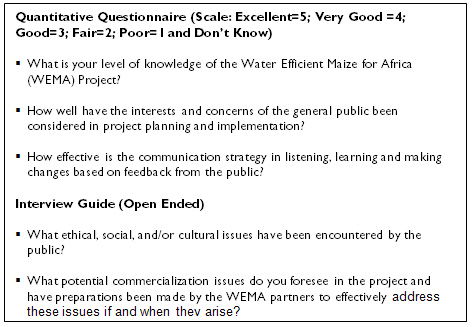

The how much money does an internal auditor make 40 is the most popular measure of stocks on the Euronext Paris and could be considered France’s equivalent of America’s Dow Jones Industrial Average . The index is made up of the largest 40 companies listed in France screened by market capitalization, trading activity, size of balance sheet and liquidity. The multinational reach of the companies listed on the CAC 40 makes it the most popular European index for foreign investors.

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate. Chip Stapleton is a Series 7 and Series 66 license holder, CFA Level 1 exam holder, and currently holds a Life, Accident, and Health License in Indiana.

Cost of CAC 40 ETFs

In comparison, most actively managed funds do cost much more fees per year. Calculate your individual cost savings by using our cost calculator. Offering Documents referring to a specific fund (including sub-funds) are available on this Website. Users should carefully read the information contained in such documents before making any investment decision. The Products described on this Website are only offered or sold to persons in any other jurisdiction, if applicable law permits this.

- Our extensive research resources and teams of experienced professionals continually analyse the relevant markets as well as the political and economic environment.

- The information published on the Web site also does not represent investment advice or a recommendation to purchase or sell the products described on the Web site.

- The fund’s top holdings are LVMH Moët Hennessy, Total SE, Sanofi, L’Oreal, and Schneider Elect SE. Its top 10 holdings account for more than half of the fund’s assets.

- Any Products described on this Website have not been and will not be registered under the U.S.

- These products and services are usually sold through license agreements or subscriptions.

2 The SRI label, launched by the French Ministry of Finance in 2016, helps to increase the visibility of SRI products for investors and savers. Products seeking to obtain the label must meet a rigorous and exacting standard to demonstrate that they are managed using robust methods, are firmly committed to transparency and provide high-quality information. Voting, and use of proxy advisors, securities lending policy and conflicts of interest see section Solutions / ESG on Integration policy incl.

CAC 40® – Performance sur 1 an

Euronext operates regulated and transparent equity and derivatives markets, one of Europe’s leading electronic fixed income trading markets and is the largest centre for debt and funds listings in the world. Its total product offering includes Equities, FX, Exchange Traded Funds, Warrants & Certificates, Bonds, Derivatives, Commodities and Indices. The Group provides a multi-asset clearing house through Euronext Clearing, and custody and settlement services through Euronext Securities central securities depositories in Denmark, Italy, Norway and Portugal.

— Data provided by Trackinsight, etfinfo, Xignite Inc. and justETF GmbH. These Terms are exclusively governed by and shall be construed in accordance with German law. Certain hypertext links on the Website may lead the User to websites that are not under the control or charge of DWS. DWS is not responsible with respect to any material contained in or conducted through any such external websites. Communications over the Internet and by e-mail cannot be guaranteed to be secure.

Top CAC 40 ETFs

Offering Documents referring to a specific fund (including sub-funds) or ETC security are available on this Website. The information on the following webpages does not constitute advice or imply that the Products are suitable for any particular investors. Investors should assess for themselves whether the Products are suitable for their own investment purposes.

The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

It is possible to use “hyperlinks” to link to this site without the knowledge of justETF GmbH. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. Yes, I understand the risks involved with investing in Short and Leveraged-ETFs. For the latest news, follow us on Twitter (twitter.com/euronext) and LinkedIn (linkedin.com/euronext).

Exposure Via ETF

Our extensive research resources and teams of experienced https://1investing.in/s continually analyse the relevant markets as well as the political and economic environment. Furthermore, our Strategic CIO View provides a long-term outlook and orientation. In addition, the independent risk function ensures that investment decisions are taken in a disciplined and controlled way. You should seek professional advice on all of the foregoing before making any investment decision.

- It is essential that you read the following legal notes and conditions as well as the general legal terms and our data privacy rules carefully.

- An active managed ETF is a form of exchange-traded fund that has a manager or team making decisions on the underlying portfolio allocation.

- The products described on this Website are not eligible for sale in all countries.

- The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America.

- The BNP Paribas Easy CAC 40 ETF launched in 2005 and aims to replicate the performance of the CAC 40 index.

The index methodology is aligned with the SRI label, a tool helping to identify sustainable and responsible investments, created and supported by the French Ministry of Finance. See the following article for more information about the size of ETFs. The Amundi CAC 40 UCITS ETF DR EUR invests in stocks with focus France.

Comparaison des performances des ETF CAC 40

Investopedia does not include all offers available in the marketplace. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

V.E provides the ESG Assessment of companies for the composition of the index and engages in dialogue with them on their ESG performance. Instead, dividends are reinvested in the fund on the ex-date, which leads to an increase of the ETF’s share price. The Amundi CAC 40 UCITS ETF DR EUR seeks to track the CAC 40® index. The CAC 40® index tracks the largest and most traded French stocks listed on Euronext in Paris.

Levered Bitcoin ETF Makes Long-Shot Bid at SEC as Crypto Rallies – Bloomberg

Levered Bitcoin ETF Makes Long-Shot Bid at SEC as Crypto Rallies.

Posted: Thu, 30 Mar 2023 07:00:00 GMT [source]

Spread and diversity are important factors to keep in mind, especially for long term investors and in this respect the CAC 40 outperforms many other market indices. The Dutch AEX index for instance often suffers from the fact that it is very depended on only a few companies that comprise of 50% of the total value of this index. The German DAX then again is very much overrepresented in a few market sectors. An active managed ETF is a form of exchange-traded fund that has a manager or team making decisions on the underlying portfolio allocation.

What are the costs of Amundi CAC 40 UCITS ETF DR EUR (C)?

The CAC 40 started with a base value of 1,000 in December 1987 and continued to operate on the total market capitalization system until 2003 when it was changed to free float-adjusted market capitalization. The Process Pillar is our assessment of how sensible, clearly defined, and repeatable CAC’s performance objective and investment process is for both security selection and portfolio construction. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. This Web site may contain links to the Web sites of third parties. JustETF GmbH hereby expressly distances itself from the content and expressly does not make it their own.

The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. The CAC 40 Index is the most important stock benchmark for French equities. The index contains the 40 largest stocks listed on the Euronext Paris stock exchange that are particularly important for the French economy. The market capitalisation of the free float determines the weighting, similar to most other stock indices.

Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. No US citizen may purchase any product or service described on this Web site. The Lyxor ETF CAC 40 aims to provide low-cost, large-cap exposure to the Paris Bourse.

Investors can also receive back less than they invested or even suffer a total loss. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. The information published on the Web site also does not represent investment advice or a recommendation to purchase or sell the products described on the Web site. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. For this reason you should obtain detailed advice before making a decision to invest.

Securities Act of 1933 as amended and trading in the securities has not been approved for purposes of the U.S. The securities may not be offered or sold in the United States, to U.S. persons or U.S. residents. The products described on this Website are not eligible for sale in all countries. The Offering Documents contain information as to the selling restrictions applicable to any particular product and the User should read them carefully. Nothing contained on this Website should be considered as an offer to purchase any of the funds. Consequently, the information on this Website does not constitute, and may not be used for the purposes of, an offer to acquire or sell any fund shares or units to any person in any jurisdiction.

Under no circumstances should you make your investment decision on the basis of the information provided here. Besides return, there are further important factors to consider when selecting a CAC 40 ETF. In order to provide a sound decision basis, you find a list of all CAC 40 ETFs with details on size, cost, age, use of profits, fund domicile and replication method ranked by fund size. The total expense ratio of Amundi CAC 40 UCITS ETF DR EUR amounts to 0.25% p.a.. These costs are withdrawn continuously from the fund assets and already included in the performance of the ETF.

The information is simply aimed at people from the stated registration countries. The videos and white papers displayed on this page have not been devised by The Financial Times Limited (“FT”). FT has not selected, modified or otherwise exercised control over the content of the videos or white papers prior to their transmission, or their receipt by you. The videos, white papers and other documents displayed on this page are paid promotional materials provided by the fund company. Any prospectus you view on this page has not been approved by FT and FT is not responsible for the content of the prospectus.